Desai

Lopez

San Diego | NIL & Tax Strategy

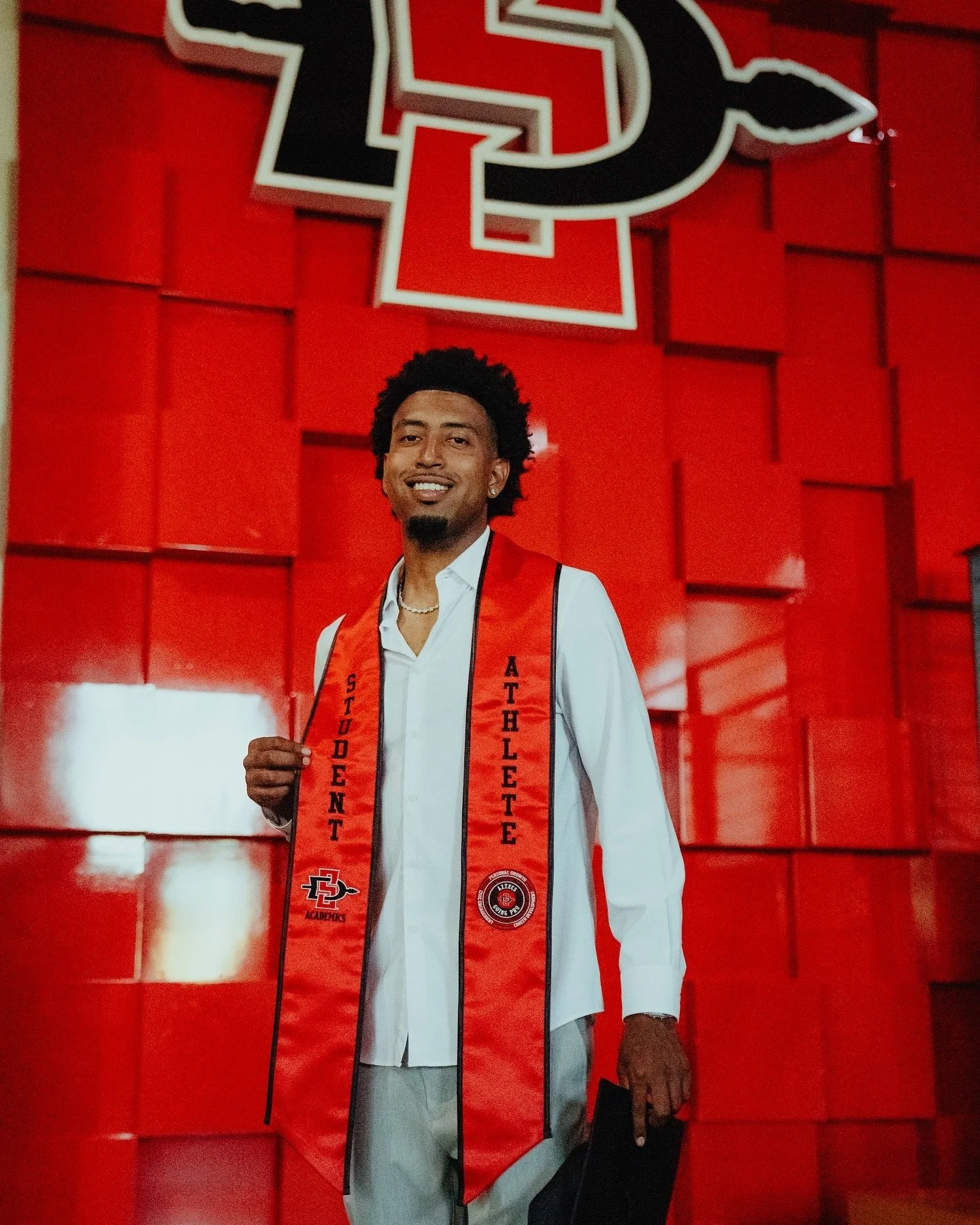

ABOUT DESAI LOPEZ

Raised in Northern California, he competed at multiple collegiate levels before walking on at SDSU, where he played two seasons and finished his career in the NCAA Tournament during March Madness. Following his playing career, Lopez earned his degree in Business Accounting and completed three part-time internships with PricewaterhouseCoopers, gaining early exposure to high-level tax and accounting environments.

While studying accounting and working in the field, Lopez saw firsthand how unprepared athletes were for the financial realities of the NIL era. Despite his accounting background, he discovered his own NIL income from his final seasons had not been properly handled due to unclear guidance and rapidly changing regulations.

Under the mentorship of Enrolled Agent David Neugart, Lopez corrected his filings and developed a clear understanding of how NIL income should be earned, reported, and protected. That experience revealed a much larger issue: if an accounting graduate could miss these complexities, countless athletes were doing the same.

Today, Lopez specializes in athlete tax advisory and NIL compliance, helping clients navigate income reporting, deductions, and long-term financial planning in an increasingly professionalized college sports environment. Through proactive strategy and education, he has helped athletes and clients recover and save over six figures in taxes they either overpaid or didn’t realize they owed.

Taxes aren’t just about filing, they are about strategy. The focus is proactive planning, client education, and long term partnership, helping clients understand their taxes, reduce risk, and stay compliant.

PHILOSOPHYSERVICESComprehensive tax services tailored to individuals, business owners, and athletes across a wide range of income

Individual and W-2 Tax Preparation

Athlete and NIL Tax Advisory

1099 and Self Employed Tax Services

Year Round Advisory and Support

Amended and Prior Year Returns